This week, I've read the biography of Wim Duisenberg, former ECB-President and President of the Dutch Central Bank. It's an excellent work by Bruno de Haas and Cees van Lotringen. It describes the career of Duisenberg and contains many interesting elements. It shows Duisenberg to be quite flexible, sensitive to atmospheres/moods. He is not so much the real interventionist ''on-top-of manager" but a listener who is very able to sense political realities and listen to differing viewpoints before choosing a path.

The authors have also succeeded in describing the international, economic and political developments surrounding the establishment of the Euro. It is clear that for this part of the book they have drawn extensively on the expertise of Andre Szasz, who was very much involved in all the proceedings towards the Euro. What I found most interesting in their book, was the description of all the discussions and developments that occured before the Euro came into being. It once again underlines that all the fuss that we now see in the Eurozone-context is not at all new.

When we now see France bashing Britain on their financial solidity, this is merely a different shape of an old discussion. Before we had the euro, the discussion could be just as tough between nations. Only the question at that point in time was: should the other country devaluate it's currency, yes or no? And in those periods we had different sort of agreements ('the snake') to glue the currency exchange rates into a certain bandwith of values. So inevitably, economic and fiscal developments in the different countries in Europe led to tensions, market reactions (declining exchange rates) just as we see the tensions occur now in sovereign bond rates.

The bottom line of where we stand right now is in my view the following. After 1972, the world has moved from the gold standard to a system of more flexible exchange rates. Whether or not these would be fully floating or subject to capital controls was a choice of individual countries. The general tendency since then is to allow for further free movement of capital and floating of currencies. Yet, the different nature of economies and countries meant that a fully free floating exchange rate might hurt the country to much. So ever since, there has been a varying set of solutions to solve this puzzle (see also this study on trade-offs in international capital flows and currency agreements).

What struck me in the book about Duisenberg, is that already in 1974 the French had a plan on the table which essentially meant that Germany and the Netherlands would finance interventions to soften the devaluation blow that the French Franc would suffer, due to economic developments of that time. It was laid aside. Eventually to reappear on the scene as the plan for the Euro. Because the French desire to counter the German economic monetary power remained ever so strong.

In the mean time, Europe decided to use 'snake mechanisms' later on, would all have the same characteristic:

- a political decision (leaning on economic insights, but not fully determined by it) on whether or not to devaluate/revaluate currencies

- an underlying agreement to assist with interventions to keep currencies within a certain bandwith,

- a lot of bickering between countries; which is why the authors of the book on Duisenberg use the term 'money wars' as subtitle to chapter 7.

So, what we see today is merely some repeated money wars between nations. The only difference is that right now it is occuring within our most recent institutional arrangement (fixed exchange rates and the euro as a single currency) rather than focusing on the subject of exchange rates themselves. We can observe that the rigid structure of the euro-arrangement now starts hurting the economies of the European Member States that are in it, as well as the countries that are out of it (Great Britain, but also the United States). Still, for now, the Member States seem keen on preserving the institutional arrangements, even if it means tough internal reforms, recession or depression.

Only time will tell if the euro will prevail without a true political union and without true support and solidarity of the people involved.

17.12.11

9.12.11

Diepere reflectie is een zwak punt bij Commissie de Wit

Vanochtend publiceerde Trouw een verkorte versie van een artikel van mijn hand over de Commissie de Wit. Een deel van mijn betoog haalde het door ruimtegebrek niet in de krantenpagina. Daarom hieronder de volledige tekst:

Diepere reflectie is een zwak punt bij Commissie de Wit

De afgelopen maand verhoorde de Commissie de Wit allerlei hoofdrolspelers uit de financiële crisisjaren 2007-2009. Wat mij bij de gesprekken opviel is de verschillende aard van de vraagstelling. De vragen over specifieke gebeurtenissen en feiten zijn doorgaans heel gestructureerd, maar het terugblikken op geleerde lessen gebeurt met open vragen. Dat betekent dat dieperliggende oorzaken minder snel aan bod komen.

Eén van de belangrijke thema’s voor de Commissie is bijvoorbeeld de rolverdeling tussen het Ministerie van Financiën en haar toezichthouders. We zien in de verhoren dat tijdens de crisis een deel van de verantwoordelijkheid voor individuele banken lijkt te verschuiven naar het Ministerie van Financiën. Zo staat De Nederlandsche Bank als toezichthouder een precisie-oplossing per instelling voor, terwijl het Ministerie zoekt naar een generieke garantieregeling (van 200 miljard) voor alle spelers.

Feit is dat op 25 juni 2009 de Algemene Rekenkamer een rapport publiceerde waaruit bleek dat het Ministerie van Financiën geen expliciete beleidsvisie op toezicht had. Terwijl het hier wel een sector betreft die tot de vitale infrastructuur van het land behoort. Het zou dan ook interessant zijn als de Commissie de Wit hier eens verder doorvraagt. Hoe komt het dat hierover destijds geen visie is ontwikkeld en op papier gezet? Lag er werkelijk geen enkel plan op het Ministerie over wat te doen bij een financiële crisis, zoals Bos deze week stelde? Dat behoort toch tot de verantwoordelijkheid van het Ministerie? Waarom kreeg dit geen prioriteit? Of was het Ministerie door een interne reorganisatie en het invoeren van de Wet Financieel Toezicht zo overbelast, dat men dit liet liggen voor de toekomst?

De vragen zouden het gesprek kunnen brengen naar eind jaren negentig vorige eeuw. Op dat moment kende de interne organisatie bij Financiën een afdeling Binnenlands Geldwezen. Daarmee was zowel de interne organisatie bij De Nederlandsche Bank als bij het Ministerie gericht op het houden van overzicht op de ontwikkelingen vanuit bankperspectief. Nadien kantelde echter de organisatie bij het Ministerie naar afdelingen per beleidsaspect. Er kwam één aparte afdeling voor marktgedrag en één voor stabiliteit. Tegelijkertijd werd een tweedeling gemaakt in het toezicht. De Autoriteit Financiële Markten keek voortaan naar gedrag van financiële instellingen en De Nederlandsche Bank naar degelijkheid. Het inherente gevolg was dat het Ministerie het integrale beeld op banken én op het toezicht kwijtraakte.

Het is opmerkelijk dat de Commissie de Wit zo weinig doorvraagt op deze organisatorische en institutionele voorgeschiedenis. Deze voorgeschiedenis is immers relevant voor alle crisisonderwerpen die zij momenteel onderzoekt. En hoe je ook denkt over de vraag wie er de meeste blaam treft bij de financiële crisis, het is in ons aller belang dat de juiste lessen worden getrokken. De Commissie ontneemt zich echter, door het gebruik van generieke open vragen, het zicht op relevante oorzaken. De reflectie blijft ondiep en afhankelijk van toevallige inzichten van de verhoorden. Daarmee blijven belangrijke lessen voor de toekomst onontdekt en dat is een gemiste kans.

Ir. Simon Lelieveldt is zelfstandig gevestigde bedrijfskundige met ruime ervaring in de banksector en een passie voor financiële geschiedenis.

Diepere reflectie is een zwak punt bij Commissie de Wit

De afgelopen maand verhoorde de Commissie de Wit allerlei hoofdrolspelers uit de financiële crisisjaren 2007-2009. Wat mij bij de gesprekken opviel is de verschillende aard van de vraagstelling. De vragen over specifieke gebeurtenissen en feiten zijn doorgaans heel gestructureerd, maar het terugblikken op geleerde lessen gebeurt met open vragen. Dat betekent dat dieperliggende oorzaken minder snel aan bod komen.

Eén van de belangrijke thema’s voor de Commissie is bijvoorbeeld de rolverdeling tussen het Ministerie van Financiën en haar toezichthouders. We zien in de verhoren dat tijdens de crisis een deel van de verantwoordelijkheid voor individuele banken lijkt te verschuiven naar het Ministerie van Financiën. Zo staat De Nederlandsche Bank als toezichthouder een precisie-oplossing per instelling voor, terwijl het Ministerie zoekt naar een generieke garantieregeling (van 200 miljard) voor alle spelers.

Feit is dat op 25 juni 2009 de Algemene Rekenkamer een rapport publiceerde waaruit bleek dat het Ministerie van Financiën geen expliciete beleidsvisie op toezicht had. Terwijl het hier wel een sector betreft die tot de vitale infrastructuur van het land behoort. Het zou dan ook interessant zijn als de Commissie de Wit hier eens verder doorvraagt. Hoe komt het dat hierover destijds geen visie is ontwikkeld en op papier gezet? Lag er werkelijk geen enkel plan op het Ministerie over wat te doen bij een financiële crisis, zoals Bos deze week stelde? Dat behoort toch tot de verantwoordelijkheid van het Ministerie? Waarom kreeg dit geen prioriteit? Of was het Ministerie door een interne reorganisatie en het invoeren van de Wet Financieel Toezicht zo overbelast, dat men dit liet liggen voor de toekomst?

De vragen zouden het gesprek kunnen brengen naar eind jaren negentig vorige eeuw. Op dat moment kende de interne organisatie bij Financiën een afdeling Binnenlands Geldwezen. Daarmee was zowel de interne organisatie bij De Nederlandsche Bank als bij het Ministerie gericht op het houden van overzicht op de ontwikkelingen vanuit bankperspectief. Nadien kantelde echter de organisatie bij het Ministerie naar afdelingen per beleidsaspect. Er kwam één aparte afdeling voor marktgedrag en één voor stabiliteit. Tegelijkertijd werd een tweedeling gemaakt in het toezicht. De Autoriteit Financiële Markten keek voortaan naar gedrag van financiële instellingen en De Nederlandsche Bank naar degelijkheid. Het inherente gevolg was dat het Ministerie het integrale beeld op banken én op het toezicht kwijtraakte.

Het is opmerkelijk dat de Commissie de Wit zo weinig doorvraagt op deze organisatorische en institutionele voorgeschiedenis. Deze voorgeschiedenis is immers relevant voor alle crisisonderwerpen die zij momenteel onderzoekt. En hoe je ook denkt over de vraag wie er de meeste blaam treft bij de financiële crisis, het is in ons aller belang dat de juiste lessen worden getrokken. De Commissie ontneemt zich echter, door het gebruik van generieke open vragen, het zicht op relevante oorzaken. De reflectie blijft ondiep en afhankelijk van toevallige inzichten van de verhoorden. Daarmee blijven belangrijke lessen voor de toekomst onontdekt en dat is een gemiste kans.

Ir. Simon Lelieveldt is zelfstandig gevestigde bedrijfskundige met ruime ervaring in de banksector en een passie voor financiële geschiedenis.

Labels:

financial history,

lessons,

palace

18.11.11

Lessons from the crisis..... liquidity is the alpha and omega of a bank !

These days we are witnessing quite some turmoil in financial markets. Just as in the days after Lehman Brothers failed, the trust has gone. And with it the liquidity in the markets. Liquidity is also the underlying theme of the public hearings of the (Commission deWit 2) that these weeks occur in Dutch parliament.

Throughout the interviews it has become clear that the Dutch Fortis bank depended on the Belgium holding for its liquidity. And it did not have a big say/influence on the strategy of its Belgium holding. So when things went really wrong they saw the money move out and had little means of repairing/countering the liquidity outflows that were the result of the bad reputation that Fortis had gotten in the market.

In a slightly different case, ING incorrectly thought that the decline of value in Alt-A holdings in 2008 was due to lack of liquidity in the Alt-A market. They failed to understand in time that it was caused by a decrease in value and valuation. So just before they really needed it, ING got rid of what it considered 'excess liquidity' in the bank. To quickly discover that they did need that capital after all. Which lead to the State investing in core-tier 1 capital and to the illiquid asset arrangement for Alt-A.

The fact that sufficient liquidity is at the heart of each bank is of course not a new lesson for bankers. The Amsterdamsche Bank for example, was set up in 1872 just at a moment in time when the market slowed down. And rather than jumping in the market, the bank decided to remain quite liquid, forbearing possible 'temporary profits' as they described it in their first Annual Report.

So, going back some years to the year 1946, we can find one of the main lessons of todays public hearings, neatly formulated in the Commemorative Book on 75 years of Amsterdamsche Bank: 'The board of the Bank has, as we shall see later, accounted for the fact that under some circumstances even liquid assets such as collateralized 'prolongatiën' can become illiquid. Already in the first years of the existence of the Amsterdamsche Bank, the board has kept a keen eye on the the alpha and omega of a healthy bankpolicy: liquidity - which is safety for the creditor - and the Board has never in its 75 years diverged from this (policy)principle.'

Throughout the interviews it has become clear that the Dutch Fortis bank depended on the Belgium holding for its liquidity. And it did not have a big say/influence on the strategy of its Belgium holding. So when things went really wrong they saw the money move out and had little means of repairing/countering the liquidity outflows that were the result of the bad reputation that Fortis had gotten in the market.

In a slightly different case, ING incorrectly thought that the decline of value in Alt-A holdings in 2008 was due to lack of liquidity in the Alt-A market. They failed to understand in time that it was caused by a decrease in value and valuation. So just before they really needed it, ING got rid of what it considered 'excess liquidity' in the bank. To quickly discover that they did need that capital after all. Which lead to the State investing in core-tier 1 capital and to the illiquid asset arrangement for Alt-A.

The fact that sufficient liquidity is at the heart of each bank is of course not a new lesson for bankers. The Amsterdamsche Bank for example, was set up in 1872 just at a moment in time when the market slowed down. And rather than jumping in the market, the bank decided to remain quite liquid, forbearing possible 'temporary profits' as they described it in their first Annual Report.

So, going back some years to the year 1946, we can find one of the main lessons of todays public hearings, neatly formulated in the Commemorative Book on 75 years of Amsterdamsche Bank: 'The board of the Bank has, as we shall see later, accounted for the fact that under some circumstances even liquid assets such as collateralized 'prolongatiën' can become illiquid. Already in the first years of the existence of the Amsterdamsche Bank, the board has kept a keen eye on the the alpha and omega of a healthy bankpolicy: liquidity - which is safety for the creditor - and the Board has never in its 75 years diverged from this (policy)principle.'

Labels:

AMRO,

Amsterdam,

financial history,

lessons

6.11.11

Amsterdam in 1597.. very enjoyable book by van Tussenbroek

I have just finished reading the book: Amsterdam in 1597, by Gabri van Tussenbroek. Van Tussenbroek is a historian who works for the city of Amsterdam and this book described all the months of this important year. It's the year that the first boats came back from the Indies. But it is also the year that the survivors returned from their voyage with Willem Barentsz around the North Side. The book is written from the perspective of book publisher Cornelisz Claesz and succeeds in giving the reader a sense of what living in Amsterdam must have been like. I can really advise anyone to buy, read and enjoy it !

The book also outlines that Claesz published a book (in 1586) with descriptions of the coins in circulation and use in Amsterdam around that time. Because money circulated in all forms and varieties, with one guilder of 1597 being the equivalent of about 13 euro today:

1 pond Vlaams = 6 gulden

1 gouden dukaat = 5 gulden, 5 stuivers

1 pond = 4 dukaat

1 pond = 20 schellingen

1 carolusgulden = geen mrekenmunt maar echte gulden

1 gulden = 20 stuivers

1 daalder = 30 stuivers

1 rijksdaalder = 50 stuivers

1 stuiver = 4 oortjes = 8 duiten = 16 penningen

Eventually, the variety of coins in circulation (of all kinds of countries) created a lot of confusion and merchants had to be very keen on checking the coins, weight etc in order not to be tricked by money traders. As a result, the city council decided to set up the 'Wisselbank', a girobank for merchants. This was done after the example in Venice, Italy. Any payment over 600 guilders had to be effected via the bank. Also the bank would exchange money and take any coin for deposit but only issue proper guilders when paying out (thus cleaning up the coins in circulation).

The book also outlines that Claesz published a book (in 1586) with descriptions of the coins in circulation and use in Amsterdam around that time. Because money circulated in all forms and varieties, with one guilder of 1597 being the equivalent of about 13 euro today:

1 pond Vlaams = 6 gulden

1 gouden dukaat = 5 gulden, 5 stuivers

1 pond = 4 dukaat

1 pond = 20 schellingen

1 carolusgulden = geen mrekenmunt maar echte gulden

1 gulden = 20 stuivers

1 daalder = 30 stuivers

1 rijksdaalder = 50 stuivers

1 stuiver = 4 oortjes = 8 duiten = 16 penningen

Eventually, the variety of coins in circulation (of all kinds of countries) created a lot of confusion and merchants had to be very keen on checking the coins, weight etc in order not to be tricked by money traders. As a result, the city council decided to set up the 'Wisselbank', a girobank for merchants. This was done after the example in Venice, Italy. Any payment over 600 guilders had to be effected via the bank. Also the bank would exchange money and take any coin for deposit but only issue proper guilders when paying out (thus cleaning up the coins in circulation).

Labels:

Amsterdam,

payment history,

Wisselbank

27.10.11

Post offices, payments and the central bank.. finding the crucial letter of De Nederlandsche Bank

Yesterday I blogged about the end of the era of Post Offices here in the Netherlands. And with that, both the Postal Office and the postal order as a payment instrument are officially gone in the Netherlands.

It's interesting to realize that about 100 years ago the situation was quite different. The economy required smooth payments and funds for the business community. And there was quite some debate on the possible introduction of a national giro-system. How that debate proceeded is a long story, but suffice to say that the central bank (De Nederlandsche Bank, DNB) was asked their opinion about starting a girosystem in the Netherlands.

DNB replied that it did not have the means and resources but suggested as an alternative to lower the fees for the postal order. Yet, the actual letter in which DNB wrote this to the Ministry of Finance, could for a long time not be found. The official historian of DNB couldn't get it, no one could and we were left with a footnote in the official historiography of DNB that the letter could not be found.

Well, that footnote triggered my curiosity and so I went searching in the national archives and used some lateral thinking. And there it was. In the archives of the Ministry of Economic Affairs. Before me, the letter of DNB of April 15, 1910, outlining that DNB themselves would not be able to set up a giro system. As such this kickstarted and paved the way for the further development and introduction of the PCGD.

Perhaps you can imagine the rush of sensation that came over me when I found this letter (already about 10 years ago). At that point in time I still thought I would quickly finish my PhD on the history of payments in the Netherlands. My plan has changed a bit however. While I may still sometime officially finalize that PhD-research-project I intend to publish bits and parts of my research on this blog.

So while I am busy writing a 'light-version' of the history of payments/banking in the Netherlands, it is with pride that I present the bit of Dutch financial history contained in this weblog: the letter of De Nederlandsche Bank NV on the introduction of girosystems in the Netherlands.

It's interesting to realize that about 100 years ago the situation was quite different. The economy required smooth payments and funds for the business community. And there was quite some debate on the possible introduction of a national giro-system. How that debate proceeded is a long story, but suffice to say that the central bank (De Nederlandsche Bank, DNB) was asked their opinion about starting a girosystem in the Netherlands.

DNB replied that it did not have the means and resources but suggested as an alternative to lower the fees for the postal order. Yet, the actual letter in which DNB wrote this to the Ministry of Finance, could for a long time not be found. The official historian of DNB couldn't get it, no one could and we were left with a footnote in the official historiography of DNB that the letter could not be found.

Well, that footnote triggered my curiosity and so I went searching in the national archives and used some lateral thinking. And there it was. In the archives of the Ministry of Economic Affairs. Before me, the letter of DNB of April 15, 1910, outlining that DNB themselves would not be able to set up a giro system. As such this kickstarted and paved the way for the further development and introduction of the PCGD.

Perhaps you can imagine the rush of sensation that came over me when I found this letter (already about 10 years ago). At that point in time I still thought I would quickly finish my PhD on the history of payments in the Netherlands. My plan has changed a bit however. While I may still sometime officially finalize that PhD-research-project I intend to publish bits and parts of my research on this blog.

So while I am busy writing a 'light-version' of the history of payments/banking in the Netherlands, it is with pride that I present the bit of Dutch financial history contained in this weblog: the letter of De Nederlandsche Bank NV on the introduction of girosystems in the Netherlands.

Labels:

DNB,

financial history,

ING,

PCGD,

post offices

26.10.11

Last Post Office closes ....

This week the last independent Post Office in the Netherlands, in Utrecht, closes. It's a beautiful building as we can see from these old postcards:

I am placing a smaller embed here, but you would most certainly want to look fullscreen (right button) and check out the Dutch page of ab-c media weblab that explains all the features and the building.

Post Offices, by tradition and definition, also play a role in financial history. They would physically transfer cash when money was sent via the Post. Also, instruments such as the 'Postwissel' (postal order) would provide a means of sending money to other people, without the need for sending the money itself. This postal order worked either within the country or to people in other countries.

But, as the Post Offices themselves are closing, with TNT Post and ING choosing their own locations for the delivery of their respective services, the postal order is by now a thing in the past. That is: here in the Netherlands; it is still available in other countries and one can of course always also use the US equivalent... Western Union.

Update as of Friday 28 October: There is a really smashing panorama foto available through ab-c media weblab and thanks to fotographer Frank van der Pol. It's a very nice example of the possibilities of panorama-photography with augmented reality touch.

I am placing a smaller embed here, but you would most certainly want to look fullscreen (right button) and check out the Dutch page of ab-c media weblab that explains all the features and the building.

Labels:

financial history,

payment history,

PCGD,

post offices

12.10.11

Occupy Beursplein 5 (Occupy Kalverstraat 25)

Anger towards financial institutions, traders or bankers is not something of just today. These days we see initiatives like: Occupy Wallstreet:

But trade and greed is of all times. In the 18th century coffee houses (koffiehuizen) would be the spot to do some extra trading. Including trades with borrowed money. And the buying of equity of new companies (not all with a solid business model). So when the equity issuing went sour and the south sea bubble burst, Amsterdam saw a sort of Occupy Kalverstraat movement. A crowd gathered and focused its anger on the coffee house at Kalverstraat 25. See also the Dutch information in this page and the picture below (showing the old coffee house and its current owner: T-mobile).

Needless to say that I was very curious what would be happening at our Wall Street here in Amsterdam. Beursplein 5. Would any of the protestors know that the square that they would be on, would be the design of a socialist and idealistic architect (Berlage)? And what would they protest about?

So I went there this afternoon and indeed there was some action. A whole podium was built. So I figured: my, my, this is an organised movement indeed. And I was impressed with this Occupy-Beursplein 5.

Then I looked a bit better. And I noticed the text. It read in big red letters: 'Stop by to consider rheumatism'. Perhaps that is somewhat typical of our Dutch willingness to revolt. Rather than occupying Beursplein 5 with protests against bank bonuses or other elements of greed, we occupy it with a rally to collect funds for people with a disease.

Would that be the Dutch way?

Update 1805: just found out via Twitter that I was three days early. It seems we need to wait for the beginning of our autumn holiday (this Saturday, 12 o clock) to start #OccupyAmsterdam...

But trade and greed is of all times. In the 18th century coffee houses (koffiehuizen) would be the spot to do some extra trading. Including trades with borrowed money. And the buying of equity of new companies (not all with a solid business model). So when the equity issuing went sour and the south sea bubble burst, Amsterdam saw a sort of Occupy Kalverstraat movement. A crowd gathered and focused its anger on the coffee house at Kalverstraat 25. See also the Dutch information in this page and the picture below (showing the old coffee house and its current owner: T-mobile).

Needless to say that I was very curious what would be happening at our Wall Street here in Amsterdam. Beursplein 5. Would any of the protestors know that the square that they would be on, would be the design of a socialist and idealistic architect (Berlage)? And what would they protest about?

So I went there this afternoon and indeed there was some action. A whole podium was built. So I figured: my, my, this is an organised movement indeed. And I was impressed with this Occupy-Beursplein 5.

Then I looked a bit better. And I noticed the text. It read in big red letters: 'Stop by to consider rheumatism'. Perhaps that is somewhat typical of our Dutch willingness to revolt. Rather than occupying Beursplein 5 with protests against bank bonuses or other elements of greed, we occupy it with a rally to collect funds for people with a disease.

Would that be the Dutch way?

Update 1805: just found out via Twitter that I was three days early. It seems we need to wait for the beginning of our autumn holiday (this Saturday, 12 o clock) to start #OccupyAmsterdam...

Labels:

financial history,

lessons

9.10.11

Old pictures of first options exchange in Amsterdam

On the website of Andre van Eerden I found some foto's of the Optiebeurs. The First Amsterdam Options Exchange opened in 1978 here in Amsterdam and was the first in Europe to do so. It stands out as another nice example of Dutch adaptation of financial innovations.

And on the foto below we see the young Wim Duisenberg watching at trades and transactions:

And on the foto below we see the young Wim Duisenberg watching at trades and transactions:

Labels:

Amsterdam Stoch Exchange,

Duisenberg,

options

5.10.11

Where was the former city hall of Amsterdam....?

As some of you may know, the big building on the Dam now known as the Palace, used to be the city hall of Amsterdam. but for many years, Amsterdam had a smaller city hall that looked like this:

In the book by Pieter Vlaardingerbroek we can read that a visit of Maria de Medici in combination with increased self-awareness led to the decision to build a new city hall. And this new city hall soon became known as the 8th world wonder, as it was so huge and full of grandeur. Quite a number of buildings were taken down to be able to build the new city hall, so that leaves us with the question: where was the old city hall?

Well, luckily the book answers that question as well. It contains a map that shows the proper location.

So we can see that the city hall was actually close to the kalverstraat (on the left). If you draw a line from the kalverstraat to nieuwendijk, you would find the city hall right on that line.

In the book by Pieter Vlaardingerbroek we can read that a visit of Maria de Medici in combination with increased self-awareness led to the decision to build a new city hall. And this new city hall soon became known as the 8th world wonder, as it was so huge and full of grandeur. Quite a number of buildings were taken down to be able to build the new city hall, so that leaves us with the question: where was the old city hall?

Well, luckily the book answers that question as well. It contains a map that shows the proper location.

So we can see that the city hall was actually close to the kalverstraat (on the left). If you draw a line from the kalverstraat to nieuwendijk, you would find the city hall right on that line.

13.9.11

View from the Bank, roof terrace Rembrandtplein, former Amsterdamsche Bank

This sunday, it was raining a bit more but just to give you an impression, here are two videos of the view form the roof terrace of the former Amsterdamsche Bank (now The Bank).

Best weather and film quality can be found on this youtube clip:

And here is this weekends, mobile phone footage:

To close off with a link to the Parool-fotoseries.

And here is this weekends, mobile phone footage:

To close off with a link to the Parool-fotoseries.

9.9.11

Quote by W.M. Westerman on dynamics of competition between big banks...

In 1920, publication occurred of the second edition of a dissertation on the concentration in the Dutch bank sector. It was written by Mr W.M. Westerman, the son of a renowned Rotterdam banker. And there is a quote about competition between big banks, which is so apt and accurate, that I am providing the Dutch and English version below. It can be found on page 147 and says that:

... in most cases of increased bank capital one can find official arguments related to liquidity or considerations with respect to the tier 1-ratio. Yet, the suspicion is justified that in most cases the continuation of the balance of power between the big banks and the urge of each bank board to increase its own remit of power, will have played a significant role. It is not possible to show examples of this from practice, due to the nature of the argument, but it can be considered a given that this argument cannot be rebutted.

Essentially we see here a very true argument from close to the inside. This is the son of a big banker from the 1920s who states that copy-behaviour and the desire to imitate, balance the power base between big banks and do what the other bankers do, can in quite some cases be more relevant than more rational considerations of return on investment. Evidence can be found in a wide variety of mergers and bank behaviour ever since (including the credit-crisis, I would say). And in my opinion this is one very important psychological factor that helps understand the shaping of the bank industry.

Now here's the Dutch text, great fun because it's written so eloquently:

Duidelijk waarneembaar is het psychologisch moment ook bij kapitaalsuitbreidingen. Ofschoon meestentijds voorgesteld en verdedigd met een beroep op de ontoereikendheid der liquide middelen of op het bereikt zijn van eener zekere verhouding tusschen eigen kapitaal en vreemde gelden, is het vermoeden gewettigd, dat de handhaving van het machtsevenwicht tusschen de grootbanken resp. de neiging van iedere bankdirectie om het eigen machtsgebied te vergrooten, bij het merendeel der uitbreidingen een niet onbeduidende rol hebben gespeeld. Uit den aard der zaak is het niet mogelijk dit aan de hand van voorbeelden uit de praktijk toe te lichten, maar dat de bewering in haar algemeenheid niet voor tegenspraak vatbaar is, mag wel als vaststaande worden beschouwd.

... in most cases of increased bank capital one can find official arguments related to liquidity or considerations with respect to the tier 1-ratio. Yet, the suspicion is justified that in most cases the continuation of the balance of power between the big banks and the urge of each bank board to increase its own remit of power, will have played a significant role. It is not possible to show examples of this from practice, due to the nature of the argument, but it can be considered a given that this argument cannot be rebutted.

Essentially we see here a very true argument from close to the inside. This is the son of a big banker from the 1920s who states that copy-behaviour and the desire to imitate, balance the power base between big banks and do what the other bankers do, can in quite some cases be more relevant than more rational considerations of return on investment. Evidence can be found in a wide variety of mergers and bank behaviour ever since (including the credit-crisis, I would say). And in my opinion this is one very important psychological factor that helps understand the shaping of the bank industry.

Now here's the Dutch text, great fun because it's written so eloquently:

Duidelijk waarneembaar is het psychologisch moment ook bij kapitaalsuitbreidingen. Ofschoon meestentijds voorgesteld en verdedigd met een beroep op de ontoereikendheid der liquide middelen of op het bereikt zijn van eener zekere verhouding tusschen eigen kapitaal en vreemde gelden, is het vermoeden gewettigd, dat de handhaving van het machtsevenwicht tusschen de grootbanken resp. de neiging van iedere bankdirectie om het eigen machtsgebied te vergrooten, bij het merendeel der uitbreidingen een niet onbeduidende rol hebben gespeeld. Uit den aard der zaak is het niet mogelijk dit aan de hand van voorbeelden uit de praktijk toe te lichten, maar dat de bewering in haar algemeenheid niet voor tegenspraak vatbaar is, mag wel als vaststaande worden beschouwd.

25th Open Monument Day celebrated in Amsterdam

Today I joined the opening of the 25th Open Monument Day in Amsterdam at the Westergasfabriek. There was a nice interview setting with Dutch tv-host: Matthijs van Nieuwkerk and all sorts of formal officials, leading up to the opening itself. And it was all very well organised awith the band (Bruut !) playing solid as well. So many cheers for all that.

The icing on the cake however was the tour to De Waag. I had the pleasure of visiting de Waag in one of the special rooms: de Chirurgijnenkamer. The anatomic theather. Which was the place where the medics at some point in time opened up bodies of deceased criminals in a small theatre setting (people could buy tickets and come watch). I listened to a brief but very clear and inspiring presentation by Jacqueline de Graauw who has done research into the older history of the Waag (the full article is just published in KNOB Bulletin).

Important findings of her research are that while from an inscription in the building it might appear that 1488 is the year in which de Waag (former Anthonispoort) was built, it is actually older. And close inspection of archives as well as the building itself reveals that de St Anthonispoort probably dates from 1462 or earlier, with a later addition in 1488. For example, if you really take a close look at the St Eloystower on the south side you can see battlements, being filled with masonry in bricks.

As the pouring rain prevented us from closely inspecting the towers and outside, I'll be back there again one of these days to have a look in detail.

The icing on the cake however was the tour to De Waag. I had the pleasure of visiting de Waag in one of the special rooms: de Chirurgijnenkamer. The anatomic theather. Which was the place where the medics at some point in time opened up bodies of deceased criminals in a small theatre setting (people could buy tickets and come watch). I listened to a brief but very clear and inspiring presentation by Jacqueline de Graauw who has done research into the older history of the Waag (the full article is just published in KNOB Bulletin).

Important findings of her research are that while from an inscription in the building it might appear that 1488 is the year in which de Waag (former Anthonispoort) was built, it is actually older. And close inspection of archives as well as the building itself reveals that de St Anthonispoort probably dates from 1462 or earlier, with a later addition in 1488. For example, if you really take a close look at the St Eloystower on the south side you can see battlements, being filled with masonry in bricks.

As the pouring rain prevented us from closely inspecting the towers and outside, I'll be back there again one of these days to have a look in detail.

Labels:

de Waag,

Monumentendag

2.9.11

Augmented reality for tours through a city...

Technology allows us to do beautiful things. Amongst others to stand with your Ipad or smartphone on a certain spot in the city and then look into the past by means of pictures or 3D virtual images. One very nice example, using the domplein can be found here on the weblab site. You can stand at the domplein and look around as if in earlier years.

It's a bit the trick of the retronaut that I am also pulling at this website, every now and then. Say that I am walking near the Biesboschstraat in Amsterdam. About here:

Then I go to a site: historicplaces.com or something like that and that pulls out the image of that GPS-position of older days:

It's a very powerful tool and of course additional local information could be added to the image. Such as this site that describes that in 1947 many kids lived and played in the streets.

I think there's room for a whole (historic-Ipad) industry that helps people look at the city as it was in older days. I noticed that the city of Amersfoort has already done quite a good job at it (click here). And as we speak I think the Amsterdam Museum is experimenting or designing such a tour for kids. So this will undoubtedly be continued.....

It's a bit the trick of the retronaut that I am also pulling at this website, every now and then. Say that I am walking near the Biesboschstraat in Amsterdam. About here:

Then I go to a site: historicplaces.com or something like that and that pulls out the image of that GPS-position of older days:

It's a very powerful tool and of course additional local information could be added to the image. Such as this site that describes that in 1947 many kids lived and played in the streets.

I think there's room for a whole (historic-Ipad) industry that helps people look at the city as it was in older days. I noticed that the city of Amersfoort has already done quite a good job at it (click here). And as we speak I think the Amsterdam Museum is experimenting or designing such a tour for kids. So this will undoubtedly be continued.....

Labels:

payment history

1.9.11

Some more news on the headoffice of Amsterdamsche Bank on Rembrandtsplein

These days I have been chatting with some friends and former colleagues about the head-office of the AMRO-Bank (first: Amsterdamsche Bank) on the Rembrandtsplein. See also the former post. These chats were about the usage of the head-office.

When Amsterdamsche Bank merged with Rotterdamsche Bank, the two former head offices were both called main-bank (hoofdbank). So there was a hoofdbank Amsterdam and hoofdbank Rotterdam. The board of AMRO resided in the office at the Rembrandtsplein, until 1987 when they moved to the South-East part of Amsterdam. And from that moment on, the directors premises in the buildings remained unused. People sometimes were taken up with the special board-members elevator in the Parking, to the directors floor. And the reason that the floor wasn't used, was because it was considered inappropriate for personnel other than directors to re-use the former board-room floors/offices.

So then, in 1990 ABN and AMRO were merging to become ABN AMRO bank. But both of the two banks wished their headquarters to become the headoffice of the new merger bank ABN AMRO. But as they didn't give in, a compromise was found by re-using the former office floors of the AMRO-Bank at the Rembrandtsplein. And when in due time, the decision was made to build a fully new head office at the South-side of Amsterdam (Zuidas), the board could then agree to move the headoffice of ABN AMRO to the AMRO building in South-East Amsterdam (Bijlmer).

When Amsterdamsche Bank merged with Rotterdamsche Bank, the two former head offices were both called main-bank (hoofdbank). So there was a hoofdbank Amsterdam and hoofdbank Rotterdam. The board of AMRO resided in the office at the Rembrandtsplein, until 1987 when they moved to the South-East part of Amsterdam. And from that moment on, the directors premises in the buildings remained unused. People sometimes were taken up with the special board-members elevator in the Parking, to the directors floor. And the reason that the floor wasn't used, was because it was considered inappropriate for personnel other than directors to re-use the former board-room floors/offices.

So then, in 1990 ABN and AMRO were merging to become ABN AMRO bank. But both of the two banks wished their headquarters to become the headoffice of the new merger bank ABN AMRO. But as they didn't give in, a compromise was found by re-using the former office floors of the AMRO-Bank at the Rembrandtsplein. And when in due time, the decision was made to build a fully new head office at the South-side of Amsterdam (Zuidas), the board could then agree to move the headoffice of ABN AMRO to the AMRO building in South-East Amsterdam (Bijlmer).

Labels:

ABN AMRO,

AMRO,

Amsterdam,

IncassoBank

26.8.11

Rembrandtsplein: Amsterdamsche Bank, Incasso Bank, Amro-bank, ABN AMRO Bank en nu the Bank

In 2 weeks time, many monuments in the Netherlands will be open to the public as a part of the National Open Monuments Day (Open Monumentendag). This years motto is 'Old building, new destiny', and aims to let the public discover how old buildings get a new destiny. I signed up to be a volunteer for the Amsterdam Monument Days and will be helping out as a guide in the Bank on Saturday the 10th and Sunday the 11th of September.

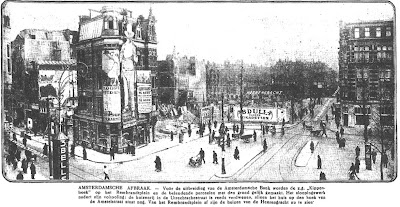

As a part of my preparations I tried to get a grip on how the Rembrandtsplein developed over the years and how the Amsterdamsche Bank evolved over time. I discovered that the area of the Rembrandstplein where they built the Amsterdamsche Bank was previously called the Kippenhoek ('chickens corner') due to the presence of the chicken-market there. And I picked up some older photo's from that area.

Here is the Kippenhoek in 1880:

And here is the same location some 44 years later, in 1924:

In that time, discussions occurred that lead to the design of the new head office of the Amsterdamsche Bank. This coincided with a change in the traffic routing on the Rembrandtsplein. More area was needed to allow cars and trams to pass by. So this paved the way for some changes. Father and Son Ouëndag worked together with Berlage to design the new head office for the Amsterdamsche Bank. They got all their sorts of permissions, so in december 1926 only a small part of the former buildings in the Kippenhoek remained:

Then, the Amsterdamsche Bank was built. On the ground floor area, there were no shops, but very small windows. And even before its realization there was some discussion about it. One merchant had argued and written to the city council that, since the Amsterdam city also had to sell some pavement to the Amsterdamsche Bank, this should be sold for a price of 250 guilders per m2 with the condition that shops or window displays should be added to the design, in order to make that side of the Rembrandtplein a bit more open. The votes on this issue were insufficient however. So here we see the finished building in approximately the same direction:

We should note that this building was close to the Turfmarkt where the central bank was located and also near to the stock exchange building on Beursplein 5. And it could be considered a smaller cousin of the other new bank building in the Amsterdam city centre: the Bazel (headoffices of the Nederlandse Handelmaatschappij). Both buildings marked a change in building styles for banks.

Over the years, the Amsterdamsche Bank merged with Incasso Bank (a takeover) and a merger with Rotterdamse bank lead to the AMRO-Bank (AMRO for Amsterdam-Rotterdam). And the head office of the AMRO-bank had to keep up with the growth. So in the 1970s the architects Zwiers and Fontein doubled the volume of the building by adding a roof ('the tent camp' in ugly white duplex), closing the atrium inside and replacing it with regular floors and by adding the neigbouring buildings. In particular the addition of the extra roof on top of the old building led to quite some protests in the city.

In 1987 the AMRO moved its headquarters to the South-East side of Amsterdam and thus became one of the first banks to initiate a move away from the prestigious city centre. As the bank merged with ABN, it became ABN-AMRO. And around 2001, ABN-AMRO decided to sell off its buildings in the city centre. Which lead to the question, what to do with the building.

A number of plans passed around the table (among which the idea to make a huge hotel) until the Kroonenberg Groep decided to invest heavily in making it an up-to-date building. Aided by architects Kees Rijnboutt en Frederik Vermeesch they have done a great job in restyling the building. This wasn't easy. At first they wanted to kick-off the ugly tent-camp in top, but as it was part of the historical elements of the building, it had to remain. So they decided to change the material and throw in quite some changes to make the building fit in the surroundings better (see their website for a number of articles about that- in Dutch).

One very clever thing they did, was open up the former Atrium inside, letting the light back in. This immediately gives the building much of its grandeur and openness.

And some 90 years later, the Amsterdam merchant has his way. The area at street level on the Rembrandtsplein is now more open, with shops for the public (Marqt, George, Amsterdam Experience). And in number of technical details, the architects have really done justice to the soul of the building. So, although the statue of Rembrandt still has his back turned to the building, I think it is fair to say that this is a very nice restauration:

But it wouldn't be fun if there was no mystery left. And the remaining mystery of the building is the Mosaic below. The architects have been unable to determine who made it or gave it or added it to the building. And I myself am also quite curious. So anyone who knows... please let me know.

As a part of my preparations I tried to get a grip on how the Rembrandtsplein developed over the years and how the Amsterdamsche Bank evolved over time. I discovered that the area of the Rembrandstplein where they built the Amsterdamsche Bank was previously called the Kippenhoek ('chickens corner') due to the presence of the chicken-market there. And I picked up some older photo's from that area.

Here is the Kippenhoek in 1880:

And here is the same location some 44 years later, in 1924:

In that time, discussions occurred that lead to the design of the new head office of the Amsterdamsche Bank. This coincided with a change in the traffic routing on the Rembrandtsplein. More area was needed to allow cars and trams to pass by. So this paved the way for some changes. Father and Son Ouëndag worked together with Berlage to design the new head office for the Amsterdamsche Bank. They got all their sorts of permissions, so in december 1926 only a small part of the former buildings in the Kippenhoek remained:

Then, the Amsterdamsche Bank was built. On the ground floor area, there were no shops, but very small windows. And even before its realization there was some discussion about it. One merchant had argued and written to the city council that, since the Amsterdam city also had to sell some pavement to the Amsterdamsche Bank, this should be sold for a price of 250 guilders per m2 with the condition that shops or window displays should be added to the design, in order to make that side of the Rembrandtplein a bit more open. The votes on this issue were insufficient however. So here we see the finished building in approximately the same direction:

Over the years, the Amsterdamsche Bank merged with Incasso Bank (a takeover) and a merger with Rotterdamse bank lead to the AMRO-Bank (AMRO for Amsterdam-Rotterdam). And the head office of the AMRO-bank had to keep up with the growth. So in the 1970s the architects Zwiers and Fontein doubled the volume of the building by adding a roof ('the tent camp' in ugly white duplex), closing the atrium inside and replacing it with regular floors and by adding the neigbouring buildings. In particular the addition of the extra roof on top of the old building led to quite some protests in the city.

In 1987 the AMRO moved its headquarters to the South-East side of Amsterdam and thus became one of the first banks to initiate a move away from the prestigious city centre. As the bank merged with ABN, it became ABN-AMRO. And around 2001, ABN-AMRO decided to sell off its buildings in the city centre. Which lead to the question, what to do with the building.

A number of plans passed around the table (among which the idea to make a huge hotel) until the Kroonenberg Groep decided to invest heavily in making it an up-to-date building. Aided by architects Kees Rijnboutt en Frederik Vermeesch they have done a great job in restyling the building. This wasn't easy. At first they wanted to kick-off the ugly tent-camp in top, but as it was part of the historical elements of the building, it had to remain. So they decided to change the material and throw in quite some changes to make the building fit in the surroundings better (see their website for a number of articles about that- in Dutch).

One very clever thing they did, was open up the former Atrium inside, letting the light back in. This immediately gives the building much of its grandeur and openness.

And some 90 years later, the Amsterdam merchant has his way. The area at street level on the Rembrandtsplein is now more open, with shops for the public (Marqt, George, Amsterdam Experience). And in number of technical details, the architects have really done justice to the soul of the building. So, although the statue of Rembrandt still has his back turned to the building, I think it is fair to say that this is a very nice restauration:

But it wouldn't be fun if there was no mystery left. And the remaining mystery of the building is the Mosaic below. The architects have been unable to determine who made it or gave it or added it to the building. And I myself am also quite curious. So anyone who knows... please let me know.

Labels:

ABN AMRO,

AMRO,

Amsterdam,

payment history

22.8.11

The future of banking, as seen in 1969 by the BBC....

I just ran into the film below, by the BBC, about how computers can change our life as a bank customer. It shows a very basic point of sale transaction with a sort of modem and huge pinpad. It's interesting to see how the world changes in some 40 years.

Labels:

financial history

20.7.11

Demolition for progress

Today I cycled past the former bank building on the corner of the Ceintuurbaan and the Ferdinand Bol. But there was no bank, merely a lot of metal, used to strengthen the concrete floor. It's not clearly visible in this Nokia-snapshot, but just trust me there was a lot of metal there.

When I looked at it, I realized it must have been the functional ground floor or basement, in which vaults or safe deposits of the Incassobank were located. Because that's the bank that was built here:

before it eventually became ABN AMRO building below...

which is now taken down to allow for the South-entrance of the newest Amsterdam subway extension (Noord-Zuid lijn).

When I looked at it, I realized it must have been the functional ground floor or basement, in which vaults or safe deposits of the Incassobank were located. Because that's the bank that was built here:

before it eventually became ABN AMRO building below...

which is now taken down to allow for the South-entrance of the newest Amsterdam subway extension (Noord-Zuid lijn).

Labels:

ABN AMRO,

IncassoBank,

retronaut

14.7.11

History of Basel II and the effects since on banking...

I just read an interesting article on the history of Basel II, the set of rules that was established, some 25 years ago to make the supervisory rules for banking reflect more of the market dynamics than the previous set of rules. The article highlights that the zero-weighting prescribed for government banks, regardless of the country in which they were based, created a bias that made banks upload tons of government treasuries of a range of countries. It made banks lazy in doing a check on the counterparty risk, although there were serious differences in the quality of the debt. And it thus also provided easy (and cheap) money for the governments. We have since learnt that that is not a good thing and that governments cannot keep on borrowing money forever. See also todays warning and possible USA downgrade by Moodys.

The author of the article outlines that at this moment we can see the European Central Bank ignoring the rating agencies qualifications of countries debt to be able to continue providing liquidity to Portuguese and Irish banks. And he goes on to outline that it is quite likely that the future will consist of different Basel-rules, in which banks will have to do better due diligence and have to use realistic measures for counterparty risks.

That is, if we are willing to learn from history.

The author of the article outlines that at this moment we can see the European Central Bank ignoring the rating agencies qualifications of countries debt to be able to continue providing liquidity to Portuguese and Irish banks. And he goes on to outline that it is quite likely that the future will consist of different Basel-rules, in which banks will have to do better due diligence and have to use realistic measures for counterparty risks.

That is, if we are willing to learn from history.

Labels:

financial history,

lessons

4.7.11

Retronaut... .interesting site.... with history of Amsterdam in retro-foto's

Today I ran across a site on the web called the Retronaut. It is a site that aims to make pictures of the situation in a city right now and compare it to earlier days. And it has a special section on (the ghosts of) Amsterdam. And the interesting thing is, this method of making pictures on exactly the same spot as many years earlier is something I quite like doing. I don't have that much readily available on financial history however.

Except for one sketch of the desgn of the main office of the Nederlandsch-Indische Handelsbank, built between 1910-1912 and designed by architects: van Rossum and Vuyk. In 1925 the building was expanded by the architect van Gendt.

The building in 1962 turned into the head-office of the Municipal Giro of Amsterdam....

which in turn became the Main Post Office in Amsterdam...

which closed in January 2011 this year and now has space to rent....

Except for one sketch of the desgn of the main office of the Nederlandsch-Indische Handelsbank, built between 1910-1912 and designed by architects: van Rossum and Vuyk. In 1925 the building was expanded by the architect van Gendt.

The building in 1962 turned into the head-office of the Municipal Giro of Amsterdam....

which in turn became the Main Post Office in Amsterdam...

which closed in January 2011 this year and now has space to rent....

Labels:

Amsterdam,

financial history,

Municipal Giro

1.7.11

Visit to the Jewish Historical Museum... fine example of a modern museum

Yesterday I had the pleasure to visit the Jewish Historical Museum in Amsterdam. And I very much enjoyed seeing both the regular expositions and the temporary ones on Dada, Triumph of Identity. It had been quite a while since my previous visit and I was pleasantly surprised. The museum has chosen to focus on the Jewish identity and history in a way that is really inviting and allows for both a more quick overview or a more in depth listen/view to video's and audiotapes. And in doing so they also managed to avoid the risk of becoming a war-museum.

To me it became more clear that since the 16th century the Dutch were a bit more open towards the Jewish people than other countries in Europe, making Amsterdam a better place to stay than other cities in Europe. Still, jewish people weren't allowed into the guilds and sought out jobs as diamond cutters and were active in (street) trade and finance. And I came to understand that Hugo de Groot helped out in outlining which legal rules to apply to jewish immigrants, using the point of view that we should welcome the jewish people to the Netherlands, not so much for the experience in trade or their economic benefit, but for the mere fact that they are human. Imagine that later on, de Groot got in trouble for his liberal point of view (that didn't suit the Calvinist yoke).

I didn't know that it took until after the French revolution that the jewish people officially obtained equal rights. And with that came an obligation to also use the Dutch language. Which was supported by some in the jewish community, but strongly resisted by others. It allowed me to further understand and reflect on being away from home and having to find a place of your own. The way in which the museum helped me look at this history and development of identity was very inspiring.

As the last bit of my tour around the museum I came to visit the Kids Museum. And it would of course be easy to leave it aside and visit only the grown-up stuff. But I didn't and thus entered the home of a family. The visit takes you through the different rooms of the house, allowing for different aspect of tradition to be highlighted. Which is all down in very bright and open manner. With a sort of Harry-Potter like speaking wall, which tells the kids the history of the building. And a music room upstairs, which helped out understanding the different jewish celebrations.

All in all, I found the museum is a real treasure that we may be really be proud of.

To me it became more clear that since the 16th century the Dutch were a bit more open towards the Jewish people than other countries in Europe, making Amsterdam a better place to stay than other cities in Europe. Still, jewish people weren't allowed into the guilds and sought out jobs as diamond cutters and were active in (street) trade and finance. And I came to understand that Hugo de Groot helped out in outlining which legal rules to apply to jewish immigrants, using the point of view that we should welcome the jewish people to the Netherlands, not so much for the experience in trade or their economic benefit, but for the mere fact that they are human. Imagine that later on, de Groot got in trouble for his liberal point of view (that didn't suit the Calvinist yoke).

I didn't know that it took until after the French revolution that the jewish people officially obtained equal rights. And with that came an obligation to also use the Dutch language. Which was supported by some in the jewish community, but strongly resisted by others. It allowed me to further understand and reflect on being away from home and having to find a place of your own. The way in which the museum helped me look at this history and development of identity was very inspiring.

As the last bit of my tour around the museum I came to visit the Kids Museum. And it would of course be easy to leave it aside and visit only the grown-up stuff. But I didn't and thus entered the home of a family. The visit takes you through the different rooms of the house, allowing for different aspect of tradition to be highlighted. Which is all down in very bright and open manner. With a sort of Harry-Potter like speaking wall, which tells the kids the history of the building. And a music room upstairs, which helped out understanding the different jewish celebrations.

All in all, I found the museum is a real treasure that we may be really be proud of.

Labels:

Amsterdam,

financial history,

lessons

27.6.11

First ATM installed 44 years ago ....

In this article, you can read that 44 years ago, the first ATM was installed by Barclays Bank in Enfield, North London. And there's a picture of that moment remaining, as Reg Varney (who played in the serie On the Buses) was asked to help out in the publicity.

Of course this development was for some time on its way. And the Dutch banks and Postal Giro Services started considering using the ATM as well. Thus, one year later (1968) the banks ABN, AMRO and NMB, started out a trial with a so-called Bank-o-maat at three banks. The ABN AMRO Historical Archive was so kind to provide me with a picture (they actually also have the actual machine somewhere in the cellars) of that machine.

The introduction of the trial was accompanied by the following article in the Amroscoop of June 1968, outlining the workings and details. It was a machine by the Swedish company Metior AB, placed by LIPS N.V. See also (in Dutch):

In the same year (1968: details forthcoming) the Postal Cheque and Giro-Services (PCGD) held a trial with an automated teller machine in Alphen a/d Rijn. I don't have a picture but somewhere hidden in my archive I do have a many-pager evaluation report on its features and future applicability for the PCGD.

Also I am aware of one other trial in 1972, where the Algemene Bank Nederland trialled a Burroughs machine in the Vijzelstraat 20 (which was for internal personnel only).

The first ATM however, to be used for regular customer purposes (not as a trial), was introduced by the former Gemeentegiro Amsterdam (GGA) in 1976. The director of the GGA, Stofkooper, had by that time most likely some hunch that some point in the future he would inevitably have to merge with the bigger Postal Giro Services. So he decided to invest heavily in all new technologies and equipment, to make sure that his bargaining position was as good as possible. And as a result the GGA was also one of the first institutions to have a well functioning on-line verification network between remote-offices and headquarters.

Of course this development was for some time on its way. And the Dutch banks and Postal Giro Services started considering using the ATM as well. Thus, one year later (1968) the banks ABN, AMRO and NMB, started out a trial with a so-called Bank-o-maat at three banks. The ABN AMRO Historical Archive was so kind to provide me with a picture (they actually also have the actual machine somewhere in the cellars) of that machine.

The introduction of the trial was accompanied by the following article in the Amroscoop of June 1968, outlining the workings and details. It was a machine by the Swedish company Metior AB, placed by LIPS N.V. See also (in Dutch):

In the same year (1968: details forthcoming) the Postal Cheque and Giro-Services (PCGD) held a trial with an automated teller machine in Alphen a/d Rijn. I don't have a picture but somewhere hidden in my archive I do have a many-pager evaluation report on its features and future applicability for the PCGD.

Also I am aware of one other trial in 1972, where the Algemene Bank Nederland trialled a Burroughs machine in the Vijzelstraat 20 (which was for internal personnel only).

The first ATM however, to be used for regular customer purposes (not as a trial), was introduced by the former Gemeentegiro Amsterdam (GGA) in 1976. The director of the GGA, Stofkooper, had by that time most likely some hunch that some point in the future he would inevitably have to merge with the bigger Postal Giro Services. So he decided to invest heavily in all new technologies and equipment, to make sure that his bargaining position was as good as possible. And as a result the GGA was also one of the first institutions to have a well functioning on-line verification network between remote-offices and headquarters.

17.6.11

Schama in Amsterdam: what todays bankers may learn from financial history

Today I visited the conference of the Amsterdam Financial Forum, with Simon Schama as one of the speakers during the morning. The excellent programme led to animated discussions on the role of banks now and in the future. And for me, Schama's insights were the icing on the cake. So I wrote down some of those insights in order to share them with a wider audience, interested in (lessons from) Amsterdam financial history.

Things aren't back to normal: financial history is highly relevant for todays bankers

Schama started out by explaining that financial history is absolutely relevant for modern finance and banking. And being in the city of Amsterdam he of course pointed out the Wisselbank and the East India Company as notable achievements, to continue with some light touch observations about the people in the room (95% bankers). He positioned himself as the man from the 'real world out there', landing on the planet where bankers reside and warned that bankers are often discussing all kind of relevant future developments with themselves (he coined this: 'echo chambers'). Schama warned the bankers that the last thing they had to do was to go back to 'business as usual'. Because todays society is not back to a usual state of being, given for example the democratisation process in the Middle-East, the trouble in Greece, Ireland and Portugal as well as the social unrest and public anger at banks. Things aren't normal at all and history can help bankers get a better grip on the developments and possibly an outlook for the future.

Amsterdam history learns: money, prudence and charity went hand in hand

Schama offered abundantly from his historical knowledge and clarified the audience that during the 17th century, in Amsterdam, there was also a lively debate about what constitutes a good banker. He cited Godfried Udemans and Erasmus (who wrote a comedy of the rich) and William Temple (Observations upon the United Provinces of the Netherlands) as writers that discussed the morality involved when accumulating money. Schama explained that along with the growth of wealth in Amsterdam came the growth of caretaking institutions such as schools, housing for widows, the eldery and so on. And he noted that at that point in time, the accumulation of money went hand in hand with charity and caring for the weak in society.

Which brought the audience to lesson number one -so to say- which is that if we want to learn from Dutch financial history, we can for example learn to not only fix our eyes on the money, but also share the accumulated wealth with the weak and needy in society. During his talk and comments Schama repeatedly outlined that -in contrast with earlier times- todays societies cut down on the medicare, schooling and similar public sector activities while mainly focusing on making money. A solid (and worrying) observation.

He outlined that Amsterdam in the 17th century made a strong distinction between deposit taking at the Wisselbank and loans at the Bank van Leening (Lombard-bank). So there was a definite awareness about what (not) to do with deposited money. In a similar line of reasoning he pointed out that later on in the 18th century, banking in the Netherlands came down to wealth management ('rentenieren') and that this activity did cost the Dutch quite some money as their business was concentrated to much on some risky governments (French..). Although the real bleeder in financial terms was the war against the French.

The crisis demonstrates that banks owe the public something and need to redefine their position

As a part of his plea for a more fundamental rethink of the relationship with society, Schama explained that in essence casino finance had brought down the economy. As a logical consequence governments have stepped in with public money. And the public thus rightly feels that they are paying for and cleaning up after the banks. Which has lead to a situation with social unrest and an angry public. He warned that in response to this generic angry feeling, banks currently face a serious challenge to redefine their relation to the angry world. And banks should not behave -business as usual- as if they are living on planet elsewhere by rearranging the deckchairs on the Titanic. A fundamental, constructive forward-looking ethical self-reflection by banks is needed and it is needed now. Is there any other or better time? If banks do not respond to this challenge now, .... when?

While I wholeheartedly agree, I couldn't help but notice that the more abstract and ethical call for action may not have landed completely with the audience. It appeared to me that most of the audience were essentially quite involved and busy in trying to implement the current new regulations (as a follow up to the financial crisis). And I have the impression that some of the banks also view this bunch of implementation work as the operational action following this ethical call for action. Yet, Schama's call went beyond just that. Essentially he put the ethical question on the agenda: if you make money with money, you cannot (as banks) simply claim or reap the full benefits of that but you should also pay dues to society. And how are you banks going to do that...?

On Europe: either the politicians show leadership or the populist trend kills the euro

Later on that day, there was a discussion about the future of Europe, given the financial trouble in Greece, Ireland and Portugal. Schama outlined that in his view European politicians should not only solve the immediate issues at hand, but should do more. He suggested that a European convention be held, similar to for example the Bretton Woods convention, in which fundamental choices and direction was made for the future of Europe and the role of its constituting nations. Such a joint European vision would help the public in all Member States understand what we are doing in Europe and why. And it is of course be up to the current politicians to show leadership in developing this vision. Because without it, the alternative might well be that in the countries of Europe the populists like Marie lePen would gain the upper hand by demolishing the euro from the inside.

Simon Schama's speech at the Amsterdam Financial Forum 2011 from Ernst & Young on Vimeo.

Whereto now?

With an abundant, varied and excellent line-up of speakers, the conference provided both practical and more fundamental avenues of thought for the best future of financial services. And I am quite curious where we will stand in one years time. So I can only hope that the Amsterdam Financial Forum will indeed become a tradition and that the initiators of this event: (Ernst and Young and Holland Financial Centre) and the sponsors (Stock Exchange Association Foundation, Capital Amsterdam and Amsterdam in Business) will choose to hold it again next year.

Things aren't back to normal: financial history is highly relevant for todays bankers

Schama started out by explaining that financial history is absolutely relevant for modern finance and banking. And being in the city of Amsterdam he of course pointed out the Wisselbank and the East India Company as notable achievements, to continue with some light touch observations about the people in the room (95% bankers). He positioned himself as the man from the 'real world out there', landing on the planet where bankers reside and warned that bankers are often discussing all kind of relevant future developments with themselves (he coined this: 'echo chambers'). Schama warned the bankers that the last thing they had to do was to go back to 'business as usual'. Because todays society is not back to a usual state of being, given for example the democratisation process in the Middle-East, the trouble in Greece, Ireland and Portugal as well as the social unrest and public anger at banks. Things aren't normal at all and history can help bankers get a better grip on the developments and possibly an outlook for the future.

Amsterdam history learns: money, prudence and charity went hand in hand

Schama offered abundantly from his historical knowledge and clarified the audience that during the 17th century, in Amsterdam, there was also a lively debate about what constitutes a good banker. He cited Godfried Udemans and Erasmus (who wrote a comedy of the rich) and William Temple (Observations upon the United Provinces of the Netherlands) as writers that discussed the morality involved when accumulating money. Schama explained that along with the growth of wealth in Amsterdam came the growth of caretaking institutions such as schools, housing for widows, the eldery and so on. And he noted that at that point in time, the accumulation of money went hand in hand with charity and caring for the weak in society.

Which brought the audience to lesson number one -so to say- which is that if we want to learn from Dutch financial history, we can for example learn to not only fix our eyes on the money, but also share the accumulated wealth with the weak and needy in society. During his talk and comments Schama repeatedly outlined that -in contrast with earlier times- todays societies cut down on the medicare, schooling and similar public sector activities while mainly focusing on making money. A solid (and worrying) observation.

He outlined that Amsterdam in the 17th century made a strong distinction between deposit taking at the Wisselbank and loans at the Bank van Leening (Lombard-bank). So there was a definite awareness about what (not) to do with deposited money. In a similar line of reasoning he pointed out that later on in the 18th century, banking in the Netherlands came down to wealth management ('rentenieren') and that this activity did cost the Dutch quite some money as their business was concentrated to much on some risky governments (French..). Although the real bleeder in financial terms was the war against the French.

The crisis demonstrates that banks owe the public something and need to redefine their position

As a part of his plea for a more fundamental rethink of the relationship with society, Schama explained that in essence casino finance had brought down the economy. As a logical consequence governments have stepped in with public money. And the public thus rightly feels that they are paying for and cleaning up after the banks. Which has lead to a situation with social unrest and an angry public. He warned that in response to this generic angry feeling, banks currently face a serious challenge to redefine their relation to the angry world. And banks should not behave -business as usual- as if they are living on planet elsewhere by rearranging the deckchairs on the Titanic. A fundamental, constructive forward-looking ethical self-reflection by banks is needed and it is needed now. Is there any other or better time? If banks do not respond to this challenge now, .... when?

While I wholeheartedly agree, I couldn't help but notice that the more abstract and ethical call for action may not have landed completely with the audience. It appeared to me that most of the audience were essentially quite involved and busy in trying to implement the current new regulations (as a follow up to the financial crisis). And I have the impression that some of the banks also view this bunch of implementation work as the operational action following this ethical call for action. Yet, Schama's call went beyond just that. Essentially he put the ethical question on the agenda: if you make money with money, you cannot (as banks) simply claim or reap the full benefits of that but you should also pay dues to society. And how are you banks going to do that...?

On Europe: either the politicians show leadership or the populist trend kills the euro